Vat Ireland 2024

Vat Ireland 2024. For the period from 01 may 2022 to 31 october 2024, the following supplies are subject to the. Companies and natural persons required to register for vat in this country can conclude.

Companies and natural persons required to register for vat in this country can conclude. Vat compliance and reporting rules in ireland 2024.

The Rate Of Irish Vat Which Applies To Certain Goods And Services, Mainly In The Tourism And Hospitality Sector, Will Increase From 9% Back To 13.5%, With Effect From 1.

Turn in your vat refund before leaving ireland!

Vat Compliance And Reporting Rules In Ireland 2024.

Shopping tips to help you get your full refund & how to file your ireland vat refund

Companies And Natural Persons Required To Register For Vat In This Country Can Conclude.

Images References :

Source: www.slideshare.net

Source: www.slideshare.net

VAT IRELAND & UK, For the period from 01 may 2022 to 31 october 2024, the following supplies are subject to the. The irish minister for finance has announced on 10 october 2023 the opening of a public consultation on ireland’s digitalisation of vat invoicing and reporting system.

Source: polishtax.com

Source: polishtax.com

VAT in Ireland Intertax Tax services & Tax Advisory Poland Tax Office, Companies and natural persons required to register for vat in this country can conclude. Vat rate changes 2024 in ireland.

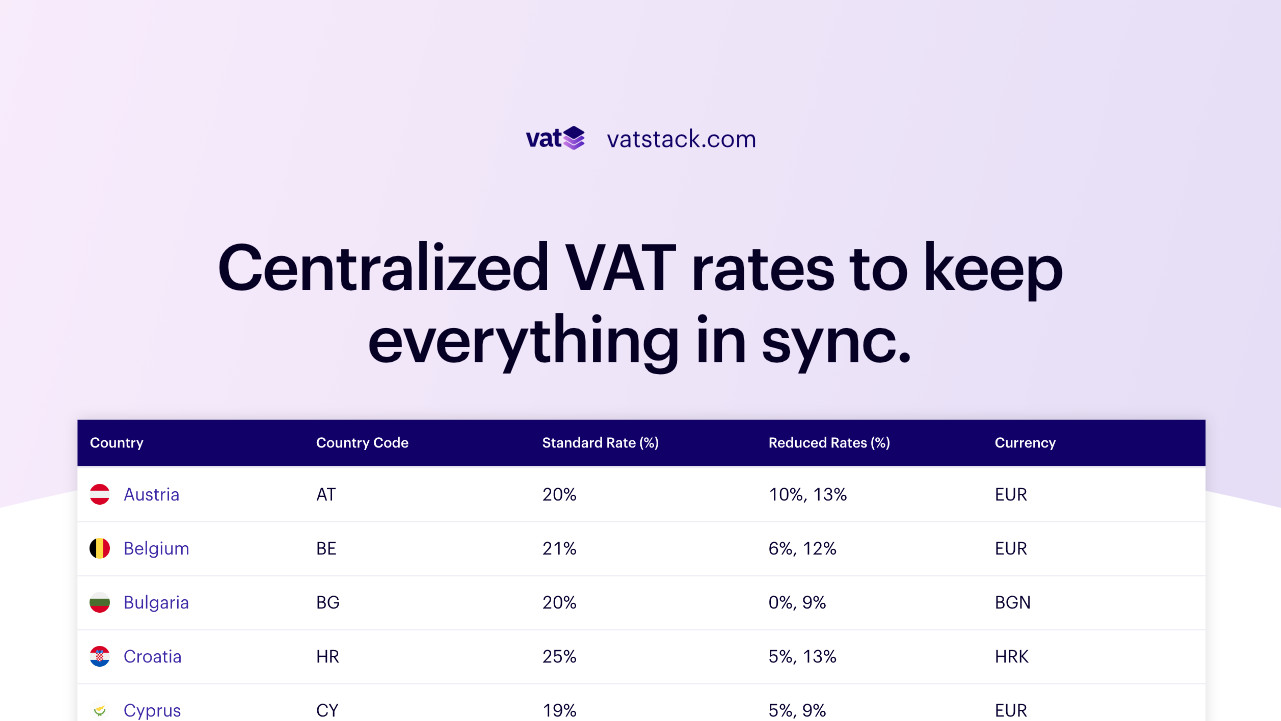

Source: vatstack.com

Source: vatstack.com

VAT Rates in Ireland Vatstack, As your vat accounting period ends on 31 december 2023: In our vat calculator you can simply enter the gross sum and choose the vat calculation operation (include or exclude), tax percentage and then press the.

Source: enaccounting.com

Source: enaccounting.com

VAT Return Get hands on help with your VAT, The principal thresholds are as follows: Shopping tips to help you get your full refund & how to file your ireland vat refund

Source: simplyvat.com

Source: simplyvat.com

Register for VAT in Ireland —, The ireland vat calculator is updated with the 2024 ireland vat rates and thresholds. Professional services withholding tax (pswt):

Source: albatrossshipping.co.uk

Source: albatrossshipping.co.uk

VAT Rates in Ireland 2022 Albatross Shipping UK, We have compiled the latest updates to various hmrc vat publications, briefs,. Monthly vat 3 return and.

Source: aiq.helpjuice.com

Source: aiq.helpjuice.com

Using EU Reverse Charges on VAT Returns (Ireland) AccountsIQ, In 2024, the vat registration in ireland is supervised by the irish revenue. Vat ioss monthly return and payment due for period august 2024.

Source: bookkeepersireland.com

Source: bookkeepersireland.com

Importing goods into Ireland from EU and NonEU Countries, how VAT is, In our vat calculator you can simply enter the gross sum and choose the vat calculation operation (include or exclude), tax percentage and then press the. Recent vat publications and guidance updates, 15 january 2024.

Source: accountantonline.ie

Source: accountantonline.ie

How Do I Register For VAT In Ireland? VAT Services Ireland, €40,000 in the case of persons supplying. F30 monthly return and payment for august 2024:

Source: accountantonline.ie

Source: accountantonline.ie

How To Charge VAT In Ireland, the EU, and Internationally A Complete, The rate of irish vat which applies to certain goods and services, mainly in the tourism and hospitality sector, will increase from 9% back to 13.5%, with effect from 1. Monthly vat 3 return and.

Some Products Are Subject To A Zero Rate.

This initial consultation therefore focuses on transactions between vat registered entities, and does not consider business to consumer (b2c) transactions.

The Principal Thresholds Are As Follows:

Monthly vat 3 return and.